Our Mission

Create value and

foster mutual growth

and benefits

We aspire to work closely with brilliant entrepreneurs and disruptive ideas, harnessing our global reach to create value and foster mutual growth and benefits. Among the many advantages our founders enjoy are shared resources, financing, networking, corporate development, and mentorship from our domain experts.

Our Approach

Leveraging the World's largest platform

Big ideas need to achieve big scale. That’s why Samsung Catalyst Fund leverages Samsung’s industry leadership and product breadth to identify, invest in, and work with innovative startups whose disruptive technologies have the potential to make the world a better place—helping people everywhere lead happier, healthier, richer lives.

-

+

Fuel new business creation

Samsung Catalyst Fund views startups as more than simply avenues for financial returns. Entrepreneurs in our portfolio get an inside track to Samsung's future growth, helping create new generations of cutting-edge business success.

-

+

Strive towards co-prosperity at a global scale

Aspiring to socially and environmentally responsible corporate citizenship, Samsung Catalyst Fund views investment success in terms of co-prosperity. That means a win for us, a win for our portfolio companies, and a win for our partner investors, startups’ customers, and the communities in which we live and work.

-

+

Aim to be transparent and nimble

Samsung Catalyst Fund is a U.S.-based fund that invests globally—fully owned by Samsung Electronics with a charter to make independent investment decisions and assume fiduciary responsibility to our portfolio companies. This structure allows the Samsung Catalyst Fund team to make rapid and transparent investment decisions while helping our portfolio companies both inside Samsung and externally.

Our Focus

Enabling life changing technologies

We believe that technology is about more than just sending faster text messages or getting better online shopping recommendations. Samsung Catalyst Fund is committed to investing in technologies—and the people bringing those technologies to market—able to deliver tangible benefits to society and to the world at large. Our sectors of interest span multiple domains including data center and cloud, artificial intelligence, networking and 5G, automotive, sensors, quantum computing and beyond.

Portfolio

We are proud to work with innovative companies driving the future of technology forward.

Ada is a global health company founded by doctors, scientists, and industry pioneers to create new possibilities for personal health.

Afero enables companies from any industry to rapidly deploy and manage IoT services for connected devices.

AI Fund is a startup initiator, building transformative AI companies from the ground up.

Atomico partners with ambitious tech founders at Series A and beyond with a particular focus on Europe.

Autotalks helps reduce collisions on roadways and improve mobility with its automotive qualified chipsets.

AvicenaTech provides chiplet interconnect solutions using novel optoelectronics, providing game-changing improvements in interconnect density, throughput, length and power consumption.

BGV is an early stage venture capital firm focused on Enterprise 4.0 technology innovation. We nurture best in breed cross-border companies from around the world.

Blaize is a new-generation computing company that optimizes AI at scale wherever data is collected and processed from the edge to the core.

Bossa Nova is a leading provider of real-time, product data for the global retail industry

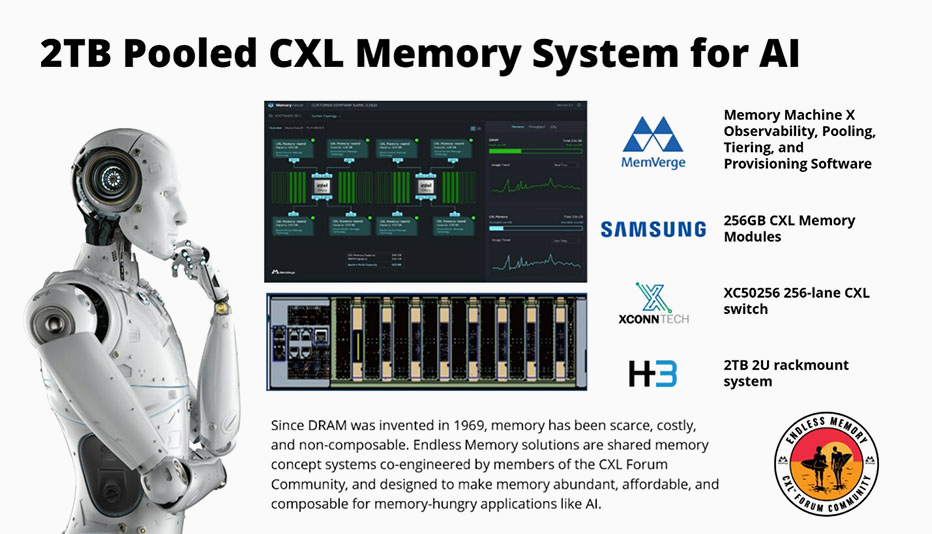

Celestial AI provides very high capacity photonic interconnect fabric technology for the datacenter and cloud.

ClearML is a pioneer in deep learning & machine learning software tools. With Allegro AI, businesses are able to bring to market and manage higher quality products, faster and more cost effectively.

Commsignia develops V2X solutions supporting smart city deployments and autonomous vehicle functions with its sensor data sharing middleware and applications.

Eliyan develops semiconductor interconnects to enable high-performance and low-power chiplet-based systems.

Empower Semiconductor was founded to solve fundamental problems in power delivery for data-intensive applications.

Genome Medical is a national telegenomics technology, services and strategy company bringing genomic medicine to everyday care.

Graphcore has created a completely new processor that’s the first to be specifically designed for machine intelligence workloads – an Intelligence Processing Unit (IPU) that will set a new pace of innovation."

Imec.xpand is an early stage and growth fund with a game-changing approach to turn hardware driven nanotechnology innovation into successful global companies.

iniVation creates high-performance neuromorphic vision systems for demanding applications in mobile, IoT, autonomous vehicles, and robotics.

Lakestar is one of Europe's leading venture capital firm investing in technology companies led by exceptional entrepreneurs.

Landing AI is an industrial AI company that provides enterprise-wide transformation programs and solutions with a focus on computer vision.

Leman Micro Devices has developed the V-Sensor, the only device that can measure all five vital signs to clinical accuracy with no additional components and is small enough and cheap enough to be built into every Smartphone.

Mantis Vision is a 3D content creation technology company, enabling high-quality depth sensing and dynamic-volumetric video capturing with live VR streaming capability."

Quobyte makes software that simplifies data center operations by turning commodity servers into a reliable and highly automated data center file system.

Renovo is an award-winning automotive vehicle software company focused on enabling the global commercialization of autonomous vehicle fleets.

Rescale is the leading hybrid HPC cloud platform delivering intelligent computing for digital R&D, and enabling more than 300 customers from startups to Fortune 50 enterprises accelerate design cycles and time to market.

SambaNova Systems provides a systems platform to run next-generation AI algorithms and applications from the data center to the edge.

Skylo is a non-terrestrial network provider, offering a service that enables smartphones, wearables, sensors, and other devices to connect by satellite

Solarisbank is the first Banking-as-a-Service platform with a full banking license that enables companies to offer their own financial products

Speedinvest is an early-stage pan-European venture capital firm with +40 investment pros and +20 inhouse operational experts working from London, Berlin, Paris, Munich, Vienna and San Francisco.

Storm Ventures is an early-stage B2B focused venture firm that specializes in building enterprise leaders.

Tenstorrent is a next-generation computing company that builds AI processors and licenses AI and RISC-V IP to customers that want to own and customize their silicon.

TriVentures invests in start-ups focusing on cardiovascular, orthopedics, robotics, ophthalmology, women’s health and digital health.

Verimi – transforming users into people. We believe in a digital world, in which every human being has the fundamental right to sovereignty over his or her digital identity.

wefox Group is the parent company of ONE and wefox. The company was founded in 2015 by Julian Teicke, Fabian Wesemann, Dario Fazlic and Teo Martino.

WEKA delivers a data platform for today's enterprise AI workloads and high performance applications. No more compromises between Simplicity, Speed, and Scale on-premises or in the cloud.

Sentiance is a data science company turning IoT sensor data into rich insights about people’s behavior and real-time context.

Unispectral develops next-generation compact camera hyperspectral imaging technology that can turn any smartphone or standalone camera into a hyperspectral camera.

Amadeus Capital invests in technology companies in a broad variety of sectors and at all stages, from seed to venture buyout.

Exits

Stellantis

AImotive delivers AI-powered enablement of Level 5 self-driving vehicles, to rapidly meet the needs of billions of people all over the world.

Mantis Vision

Alces Technology uses its high-performance 3D Depth Sensors for embedded applications including facial recognition and object scanning.

PacBio

Apton Biosystems has developed a high-throughput, low-cost sequencing platform that will revolutionize the availability and affordability of genetic analysis.

Continental

Argus provides comprehensive automotive cybersecurity solution suites to protect connected cars and commercial vehicles against cyberattacks.

Cisco

BabbleLabs enhances understanding by people and machines in business-critical audio and video content, services, and devices by providing powerful, AI-based speech software solutions.

Forcepoint

Bitglass' Next-Gen Cloud Security solutions offer granular data protection, zero-day threat protection, robust identity and access management, and complete visibility on any app or device

CRDO

Credo (CRDO) has a mission is to deliver high-speed solutions to break bandwidth barriers on every wired connection in the data infrastructure market.

VMWARE

Datrium is the leader in unified hybrid cloud computing and data management, helping enterprises run and protect business critical workloads.

Microsoft

Fungible is a stealth start up, creating a hardware + software platform for data centers.

German Bionic’s smart Cray X power suit combines human intelligence with machine power by actively supporting or enhancing the wearer’s movements, thereby reducing the risk of workplace accidents and strain-related illnesses.

Intel

Habana develops AI processors optimized for the specific needs of training deep neural networks and inference deployment in production environments.

Intel

Ineda’s silicon and platform solutions offer industry leading power/performance elasticity for the emerging workloads in IoT and Automotive applications.

INVZ

Innoviz Technologies develops cutting-edge LiDAR remote sensing solutions to enable the mass commercialization of autonomous vehicles.

IONQ

IonQ is developing the world’s leading general-purpose quantum computers. Our trapped ion platform creates a quantum computer that is as scalable as it is powerful.

Molex

Keyssa’s breakthrough Kiss Connectivity solution, uses Extremely High Frequencies (EHF) to provide low-power, high-speed data transfer, securely and simply.

Gideon Health

LVL has built the most advanced AI platform for wearables – allowing us to deliver comprehensive, medical-grade human monitoring to the next generation of consumer electronic devices.

Mapillary is a collaborative street-level imagery platform for extracting map data at scale using computer vision.

Siemens

Pixeom is a leading software platform for managing and orchestrating the distributed edge.

Boston Scientific

Preventice Solutions is an innovative healthcare company focused on mobile health solutions and remote monitoring services.

Amazon

Ring's mission is to reduce crime in neighborhoods and empower consumers by creating a Ring of Security around homes and communities with its suite of smart home security products.

SOUN

SoundHound Inc. turns sound into understanding and actionable meaning. We believe in enabling humans to interact with the things around them in the same way we interact with each other: by speaking naturally.

HPC

TidalScale is the leading provider of Software-Defined Servers that simplify the way companies can flexibly apply computing resources to problems.

VLN

Valens is the world leader in HDBaseT technology, and is a top provider of semiconductor products for the distribution of ultra-high-definition multimedia content.

Our Team

Head of the Fund

San Jose

Tel Aviv

San Jose

Tel Aviv

San Jose

San Jose

San Jose

San Jose

San Jose

San Jose

San Jose

Stay informed

Receive email updates on the latest technology, innovation and investment news from Samsung.

Locations

San Jose, CA, USA

3655 N 1st St, San Jose, CA 95134

Seoul, Korea

1, Samsungjeonja-ro, Hwaseong-si, Gyeonggi-do

Tel Aviv, Israel

4 Hahoshlim Street, Entrance B, #1 Floor, HerzliyaSubmit your pitch deck!

We’re always looking for the next great idea. Contact our team for instructions on how to submit your pitch deck.

catalyst@samsung.com